CLICK HERE TO DOWNLOAD THE REPORT

Almost overnight, the pandemic catapulted the multifamily industry into uncharted waters. Multifamily has been forced to embrace technologies, virtual tours, and remote leasing while closely monitoring rent collections and vacancies. The full impact of COVID-19 is still uncertain, as the industry battles increasing vacancies and declining rents, which are expected to recover in early 2021. Overall, multifamily has held up strong in the ultimate black swan event. The apartment sector is resilient, and according to the Matthews™ Investor Outlook Survey, there continues to be a steady interest in multifamily properties.

Improvements In Multifamily Fundamentals

In the past two U.S. recessions, multifamily rents declined the least and recovered faster than other asset classes. As of Q4 2020, there are reasons to be optimistic about multifamily fundamentals, as conditions stabilize. However, the changes in how renters live and work brought on by the pandemic have profoundly shifted apartment demands. Renters seek more space for a dedicated office, downtown renters are seeking affordability in the suburbs and regional markets, and roommates are craving a space of their own.

Below we explore what these changes have on apartment fundamentals.

Vacancy & Leasing Activity

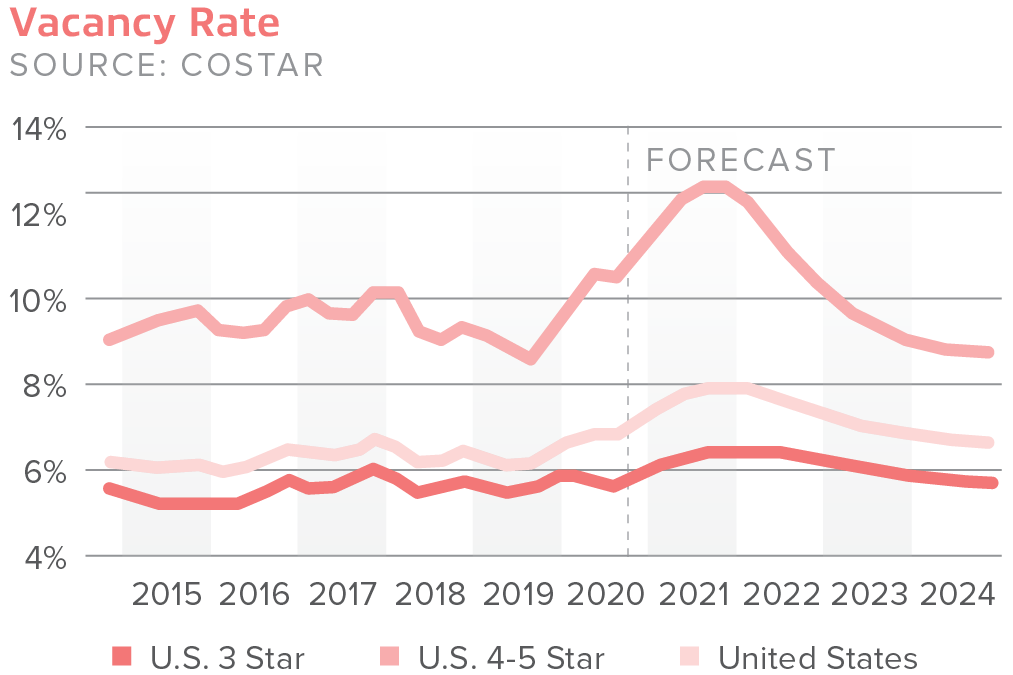

COVID-19 upended the U.S. apartment market during the prime leasing season of 2020. The U.S. apartment vacancy rate hit a 22-year high in Q2 2020, and for the first time, increased by 50 basis points in the first half of 2020. However, around June 2020, leasing activity returned to normal levels and has remained stable since, despite a record number of units delivered in Q3 2020. As of Q4 2020, the U.S. apartment vacancy rate level sits at 6.7 percent.

Vacancies Remain Steady Despite New Deliveries

In Q2 2020, around 65,000 units were absorbed in the market, the weakest second quarter in years, and less than half of the units absorbed in 2018 (138,000 units) or 2019 (116,000 units). On the other hand, net absorption for suburban apartments in Q2 2020 was in line with the past few years. Overall, Q3 2020 vacancies held steady despite the absorption of around 111,000 units, a third-quarter record. Vacancies in downtown product continued to rise over nine percent as of Q4 2020, while suburban vacancies have fallen back to around six percent.

As more units are delivered around the nation, it is forecasted that vacancy rates will rise by at least another full percentage point before fully recovering in 2021. There were more renewals in the apartment space, as opposed to new leases during the height of COVID-19. This demand reduction can be due in part to the retraction of urban units. Third-quarter demand suggests that many renters delayed moving to a new apartment until after COVID-19 lockdown restrictions were lifted in states. Record-level search activity on apartments.com suggests pent-up demand remains and the pandemic may have increased turnover in apartment units as renters change their housing needs.

Landlords welcome this good news, and the increased demand will favor several multifamily assets, including:

- Suburban, Class B communities offering high-quality finishes

- Three and four-bedroom units at affordable prices

- Discounted high-end units in regional markets that offer familiar urban amenities

Markets That See Increasing Vacancy Levels

The demand for rentals in gateway markets has virtually evaporated. CoStar estimated that approximately 12,000 renters moved out of downtown units, resulting in vacancies jumping almost two full percentage points. The markets that have shown the most significant decreases in demand include CBDs in Boston, Los Angeles, the Bay Area, Washington, D.C., and Seattle. Florida markets, including Palm Beach, Miami, and Orlando, have also posted some of the most considerable demand losses, as the state’s all-important tourism industry remains inactive.

New Leasing Terms

Short-term leases have risen in popularity and leases have transformed to be more personalized per renter household. According to a survey from the National Apartment Association, nearly 35 percent of landlords said that some portion of tenants renewing leases signed short-term lease structures, such as month-to-month. In 2021, it is expected that the pent-up demand from the short-term tenants will absorb the new deliveries in the market.

By utilizing technology, apartment owners and operators increased leasing activity through virtual tours in April 2020. This system will likely not disappear post-pandemic and will be used by many apartments to attract new tenants. Further, rent deferral programs, force majeure, and personalized payment plans will be more common in new leases moving forward.

Rent Trends

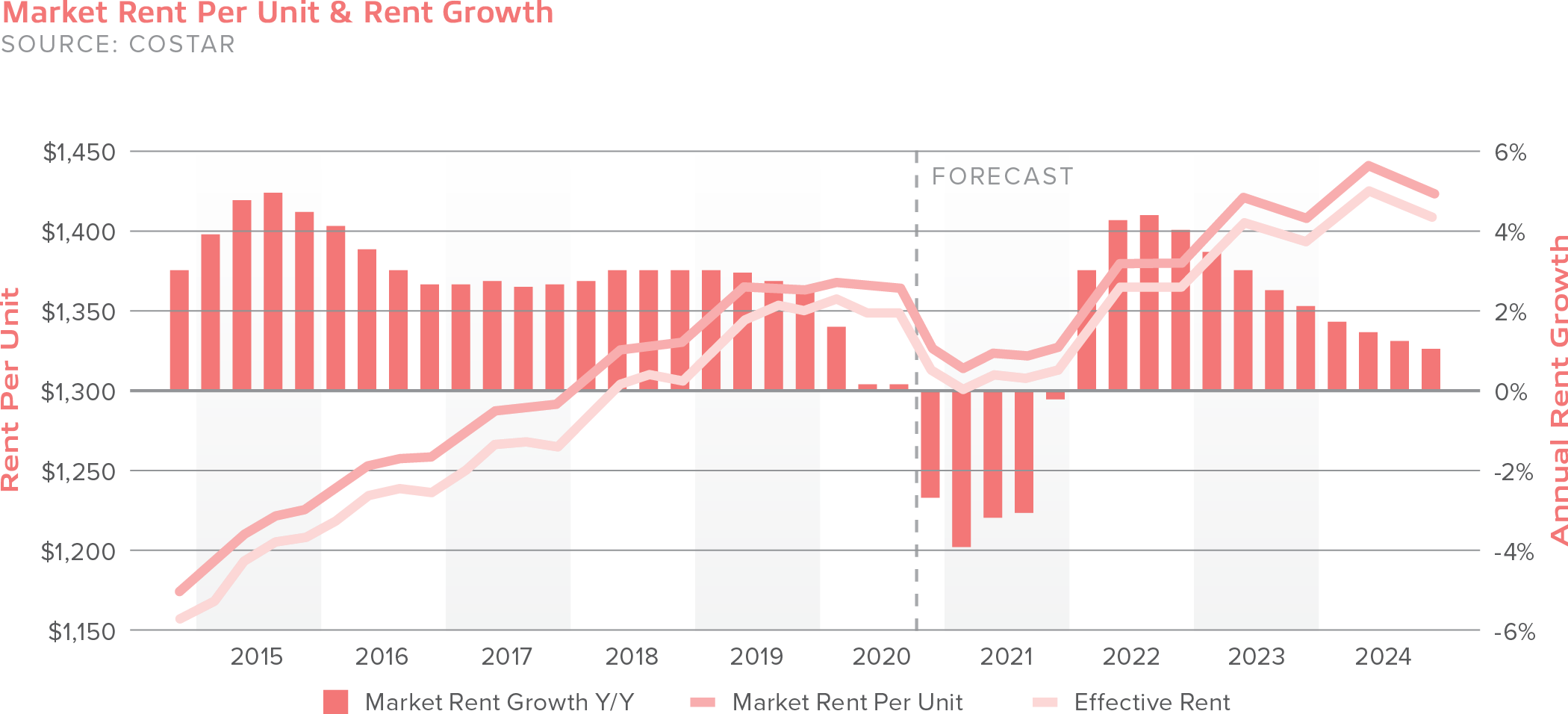

The federal $2 trillion coronavirus relief bill expired at the end of July, leaving many unemployed households without the $600 a week supplement in employment insurance. Renters-by-necessity were impacted by the lockdown in the spring and are considered the most vulnerable. Year-over-year rent growth was essentially flat in Q3 2020, after rising by 2.5 percent in 2019. Apartment rents are down one percent since mid-March, according to CoStar, and are expected to fall another three percent through mid-2021 before recovering at the end of the year.

Renters Seek Affordability in Suburbia

There is a growing divergence between affordable suburban markets and expensive gateway urban markets. Rental trends show an increasing preference for suburban apartments, which have risen since mid-May and now exceed pre-COVID-19 levels. Urban CBDs see rents decline at an accelerated rate, down more than four percent from the March peak. According to data from Apartment List, rent debt improved slightly in September 2020, with 32 percent of renters owing back rent to landlords down from 34 percent in August.

The Rise of Concessions in Urban Markets

The suburban markets that see rent growth face limited supply risk, as low rents have deterred development over the past decade. Urban markets, on the other hand, have large supply pipelines, and the dwindling urban renter pool will weigh on rents as units are delivered. Nearly half of downtown communities are offering some form of concession, according to CoStar.

The Eviction Moratorium Cloud

Through most of 2020, a national eviction moratorium has been under effect. This moratorium prevented landlords from evicting tenants who didn’t pay rent until December 31st, 2020. Although the previous eviction ban that was part of the CARES Act only covered certain properties, this moratorium effectively protects everyone living in one of the nation’s roughly 43 million rental households, regardless of the building they live in. Some states have their own eviction bans in place, including California. AB 3088, a California tenant relief act, bans evictions of tenants who can’t pay rent due to COVID-19 hardships until February 1st, 2021. However, tenants who fell behind on rent must have signed a declaration form and submitted it to their landlords, indicating that they’ve lost income due to the COVID-19 pandemic and have made an effort to look for financial assistance.

Construction Data

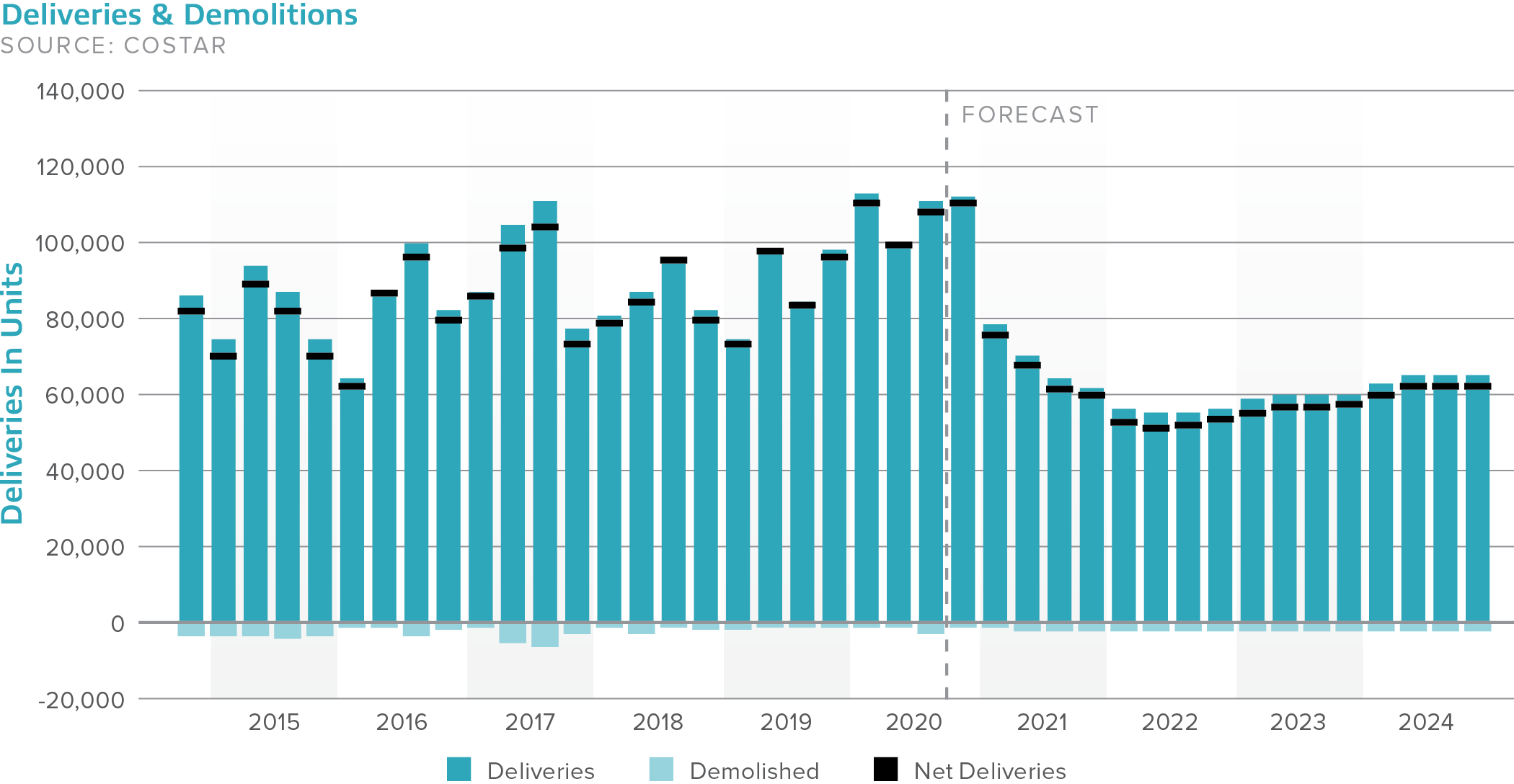

In this business cycle, multifamily construction has come out as a leader. Although the pandemic did disrupt multiple industries, it did not stop construction. Except for a few pockets of supply in coastal markets, the industry is not considered to be overbuilding today.

Fewer than 300 new projects, totaling less than 60,000 new units, commenced in Q3 2020, the lowest total of 2019. However, in the first half of the year, a record-breaking 210,000 units were delivered, and another 600,000 units are currently under construction, accounting for 3.4 percent of current inventory. According to CoStar, an estimated 400,000 units will be finished over the next 18 months. Downtown Dallas leads the market for the percent of inventory underway, trending near 25 percent.

Miami, Tennessee, and Charleston face the highest supply risk, with more than nine percent of stock underway. Boston, Charlotte, Palm Beach, Raleigh, Seattle, Orlando, and Austin all have at least six percent underway. Assuming that half of the projects under construction delivered end of 2020 and little demand materializes, vacancies in these markets could rise above ten percent. (Source: CoStar)

A Weaker Demand Environment

Urban construction is underway in many markets, and unfortunately, units will deliver into a weaker demand environment. Current prospective renters are favoring affordability, large floorplans, and suburban locations. However, the new units coming to market boast luxury pricing, small floorplans, and are located in downtown areas. With opposite demand factors, these units will sit on the market longer, and standard seasonal patterns will produce weaker demand in the winter months.

Construction Delays

With construction underway in many markets, there was a sharp decline in construction starts, permitting, and delivery since the pandemic began. Nearly 200,000 units are behind schedule. Among the reported delays, 83 percent said permitting delays were an issue, and 71 percent reported significant pause in construction starts, according to a National Multifamily Housing Council report. Of those that reported construction start delays, 56 percent said they were due to permitting, entitlement, and professional services. Construction has resumed in almost all states, and the availability of labor has aided in getting projects back on track.

Sales Trends & Transaction Volume

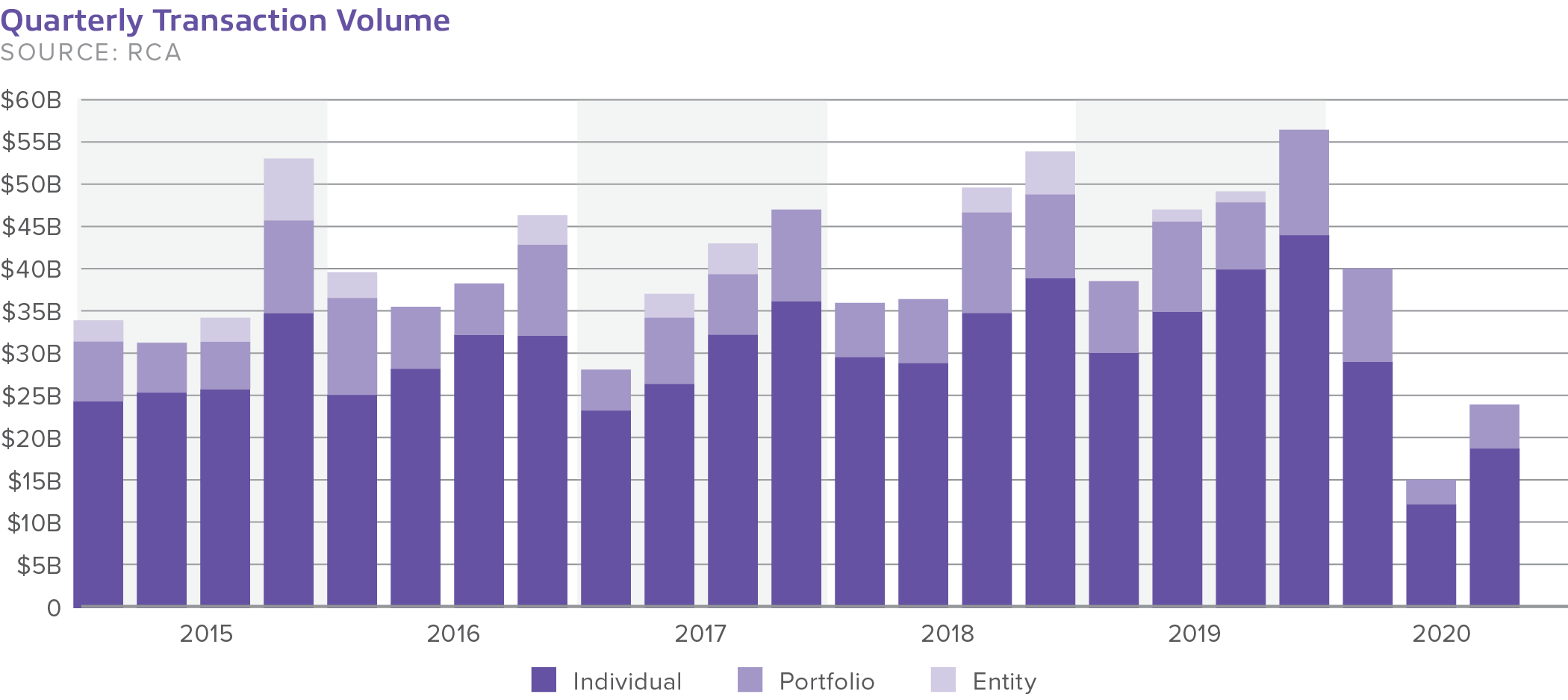

From the pace of activity seen a year ago, apartment deal volume fell sharply in Q3 2020. However, there are clear seasonal patterns in deal activity for the apartment sector. For instance, the market always sees a surge in December activity as investors rush to get deals completed before year-end. Typically, Q3 volume is only 18 percent larger than Q2 activity, but Q3 volume was 56 percent higher this year. The fall in deal volume seems to be decelerating, with volume down 67 percent year-over-year, suggesting that the worst may be over. Overall, the apartment market shows improvement.

Transaction Volume Compared to the Last Recession

Deal volume in 2020 did not fall as much as it did in the Global Financial Crisis. Multifamily volume hit an average pace of $20 billion per quarter in both Q2 and Q3. By contrast, deal volume averaged only $4.3 billion per quarter in Q2 2009 and Q3 2009. According to RCA, apartments were the largest sector for transaction volume in August 2020, accounting for 40 percent of all commercial real estate sales.

The Pricing Battle Between Buyers and Sellers

Uncertainty around the economy and apartment demand weighed heavily on potential multifamily buyers in 2020, as investors pulled back. Owners and buyers did not see eye-to-eye on asset pricing, explaining much of the shortfall in 2020. Many thought that pricing should have declined by at least three to seven percent, considering market conditions. However, sellers thought that debt was still cheap, and with multifamily being a prized asset class, the decline in pricing, if any, should be under three percent. According to the Matthews™ Investor Outlook Survey, many investors decided to refinance in 2020 instead of selling or chose to wait on the sidelines until 2021 when the market is predicted to stabilize and buyer expectations return to pre-pandemic levels.

What Assets Are Trading?

Roughly $15 billion in multifamily assets traded in the second quarter of 2020, a fraction of the recorded $51 billion that traded in Q2 2019. The fall in deals involving individual assets largely tracked the market overall in Q3 2020. Individual asset sales were down 52 percent year-over-year, and acquisitions by equity funds, national owners/developers, and REITs were down more than 80 percent. Local players were relatively more active, as many believed to have a better understanding of their local markets and can more easily visit properties to do complete due diligence. However, according to RCA, portfolio activity drove volume in 2020 as there were no M&A-type deals. Portfolio sales were slightly more important for the mid to high-rise segments, constituting 23 percent of Q3 deal volume. Portfolio deals represented 19 percent of the garden apartment sale activity, according to RCA.

Per RCA data, 13 apartment portfolios traded at a price above $100 million in Q3 2020, located in markets across the country. One notable sale involved AIMCO buying a partial interest in a portfolio of assets in Northern and Southern California, which valued the portfolio at roughly $2.4 billion, or $607,800 per unit, at a quoted 4.2 percent cap rate. Despite fears that people might flee California due to restrictions, investors still see opportunities there.

Markets That See Success

Deal volume in the Bay Area held up relatively well, down 47 percent of normal levels, compared to 99 percent in markets like Las Vegas. The Bay Area was also boosted by a large number of 1031 exchange deals. Investment activity in Denver, Austin, Phoenix, Seattle, and Charlotte also held up relatively well, as regional investors remained moderately active, according to CoStar. Some markets posted higher deal volume than usual, including Jacksonville, Minneapolis, and Salt Lake City, where the largest deal of the Q3 2020 occurred. Oakmont paid $178 million in May for a newly built 453-unit complex in downtown Salt Lake City. The most active market in 2020 was Dallas-Fort Worth, which outpaced both New York and Los Angeles. According to CoStar, Dallas-Fort Worth completed a total of around $2.5 billion in Q2 and Q3 (estimated for nondisclosed deals).

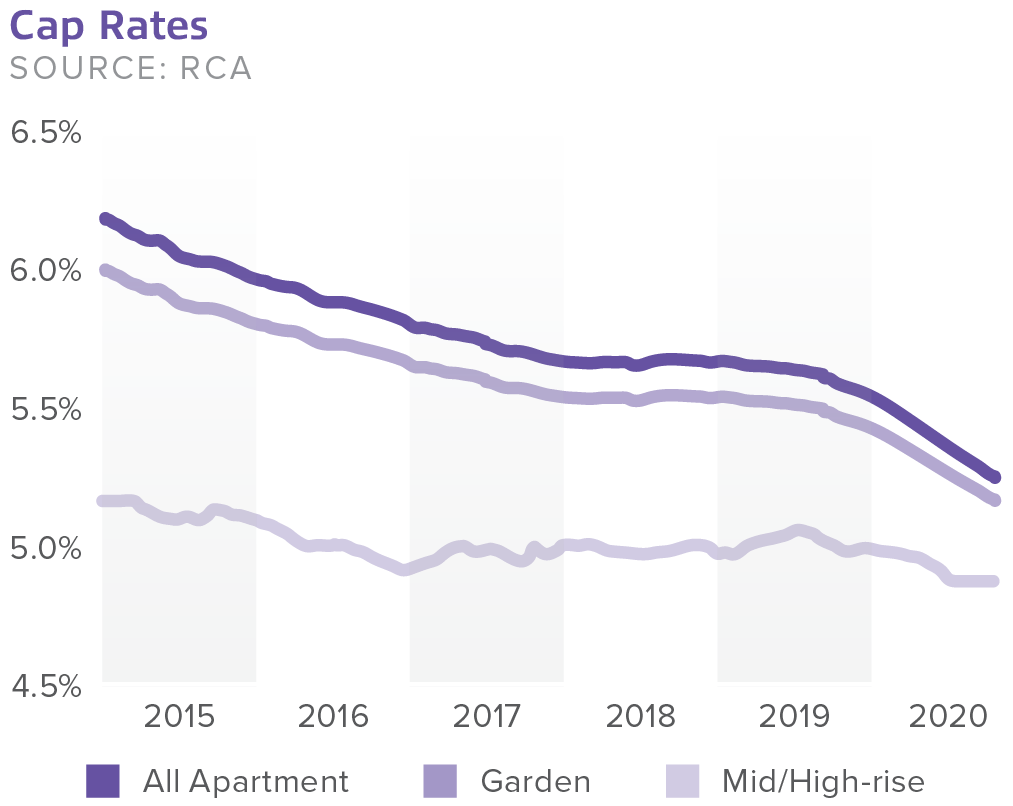

A Look at Cap Rates

Apartment cap rates were mostly unchanged from a year earlier. In Q3 2020, the cap rate for mid to high-rise assets climbed ten bps from a year earlier to five percent. However, this is not a result of COVID-19. Cap rates for this segment of the apartment market have been rising due to competition from new supply and more onerous rent control regulations in certain markets. For garden apartment assets, cap rates also fell ten bps to reach 5.3 percent, a record-breaking low.

Debt & Equity

The debt markets are aiding in supporting property prices in the sector. Refinancing activity accounted for half of all capital flows to commercial real estate in the first half of 2020. Further, commercial mortgage rates have remained stable, despite a sustained low-level in the interest rate environment. Through 2020, interest rates held up and even improved. Rates have reached one of the lowest levels—2.65 percent to 2.85 percent from agencies and full-term interest-only. In brief, there is less competition today than a year ago. Debt is still readily available in the market, something that wasn’t during the Global Financial Crisis.

If COVID-19 carries deep into 2021, the market could see potential hardship. However, according to a new report from the Federal Reserve, the overall U.S economy is expected to grow in 2021. The Fed now expects real gross domestic product (GDP) for 2021 to drop only 3.7 percent, compared to the negative 6.5 percent projection in June. Additionally, the Fed projects GDP growth of roughly four percent and an unemployment rate of 5.5 percent. The first half of the year will determine the multifamily sector outlook, and recovery is expected in Q1 2021.