Considered an essential business by the U.S. government during COVID-19, convenience stores (c-stores) are often the only or closest location for much-needed fuel, food, and grocery items. Looking back to 2019, in-store sales at c-stores increased by 4.4%, according to the National Association of Convenience Stores (NACS). However, in the face of a global pandemic, fuel demand has dropped drastically, and with it, returning customers as companies push for work-from-home and schools temporarily close. Even with these considerable challenges, c-stores have proven to be resilient, and many operators are seeing new customers, rediscovering their local c-store. This provides an excellent opportunity for owners to reevaluate their c-store and operations as they are no longer reliant on their routine customer—how convenience stores react could result in an expanded loyal customer base.

Navigating the Coronavirus

After experiencing out of stock items at grocery stores and avoiding crowded areas, consumers have started to flock to their nearest c-store. NACS recently conducted a survey, which revealed overall foodservice sales had decreased, but 52 percent of c-store grocery sales increased, despite only 17 percent of consumers leaving their house for work or school according to Datassential, a foodservice analytics company. Foodservice sales in 2020 have been impacted as a result of the extra precaution retailers are taking. C-store employees have moved self-serve items behind the counter to prevent the risk of contamination.

Immediate consumption items account for 83 percent of convenience store sales and typically are the more popular products purchased. C-stores are pivoting to offer more items that can be taken home, including:

- 52% more cleaning and toiletry items

- 31% more pre-assembled meals

- 28% more bulk items

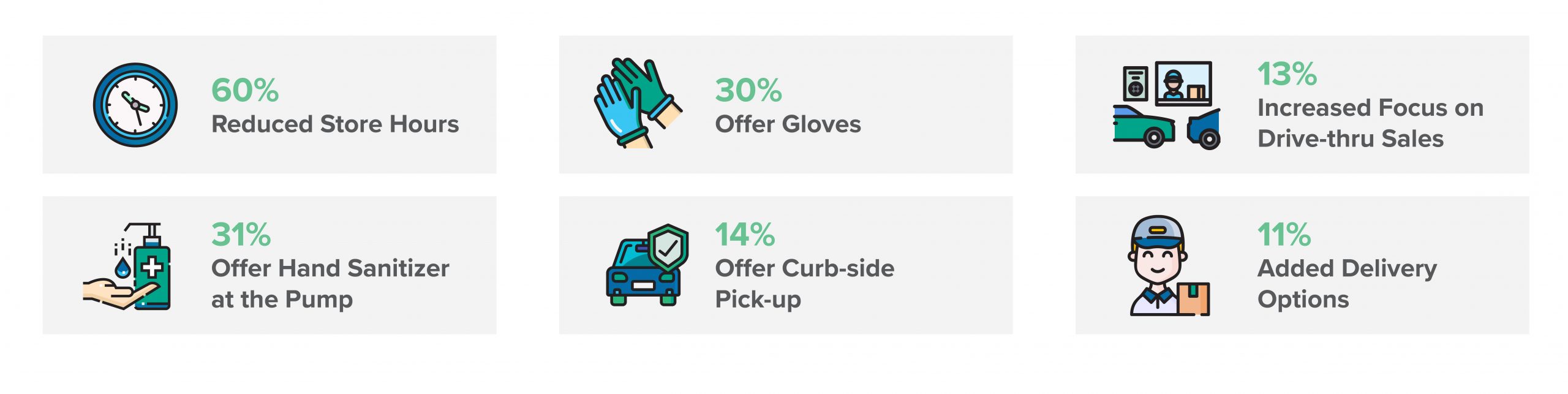

Convenience retailers were quick to address COVID-19 in their stores. Whether it was enhanced cleaning protocols or removing self-service stations, c-store operators wanted to keep their customers confident and returning. Almost half reported their current distribution system is working, while 18 percent are supplementing other delivery methods in addition to their current system. To meet increased demand 7-Eleven plans to hire 20,000 store and restaurant employees.

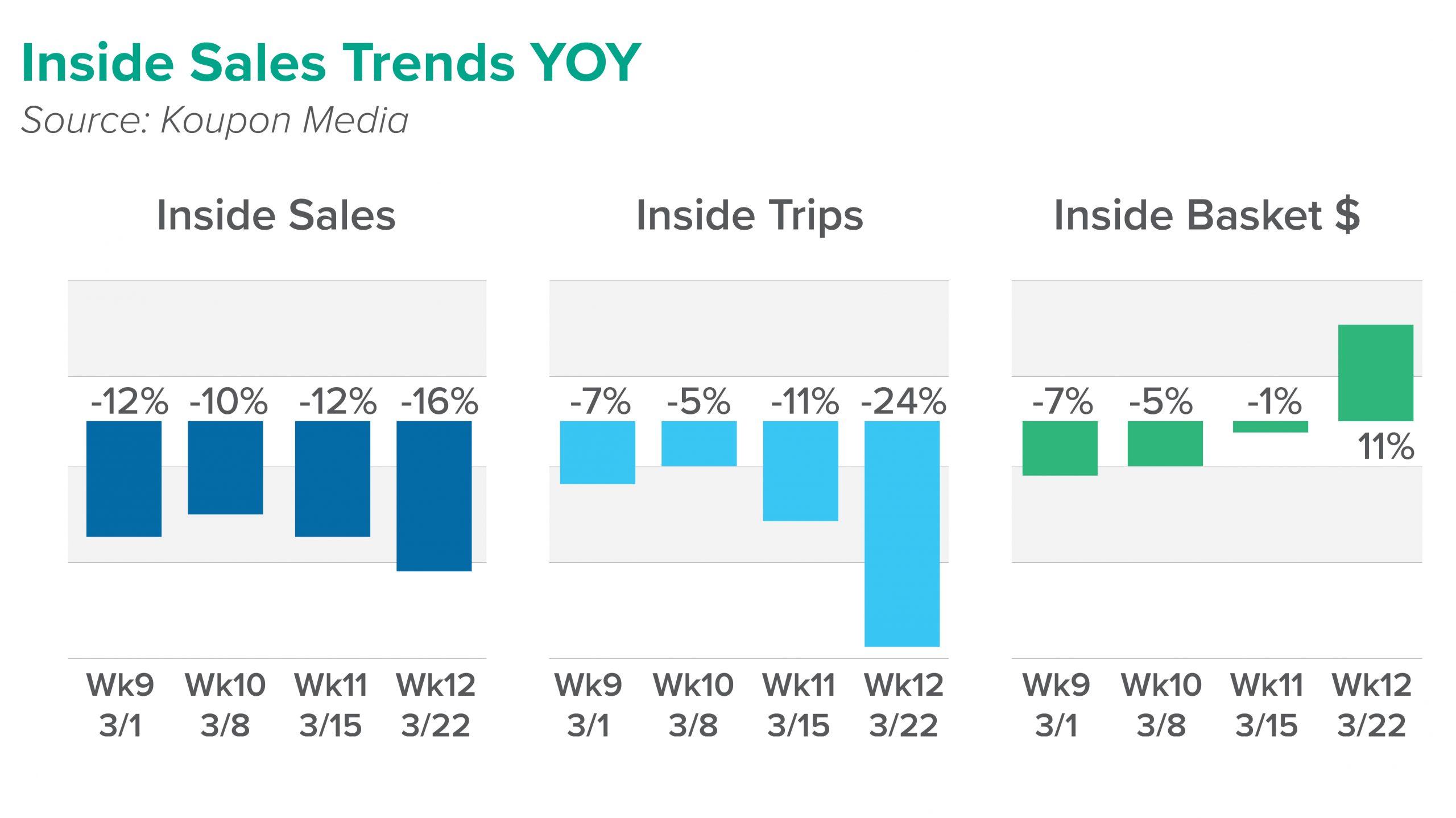

The graph below showcases the decline in in-store shopping, but an increase in basket size, referring to the number of items customers check-out with, indicating that shoppers are spending more. C-stores that offer self-service and restaurant functions have scaled back by closing 66 percent of their public seating and dining areas, and 45 percent removed access to self-service items, like fountain drinks, bakery pastries, and coffee.

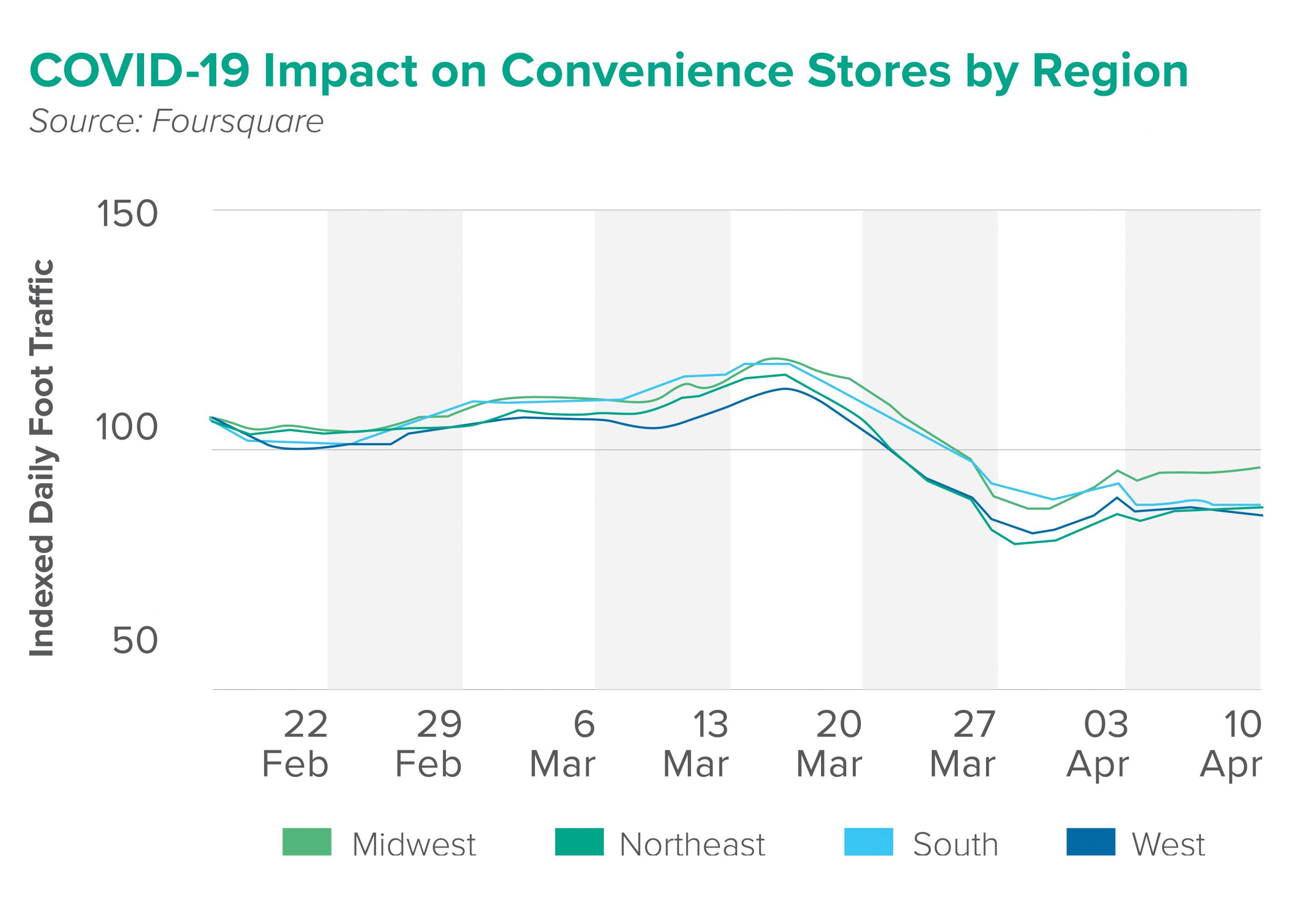

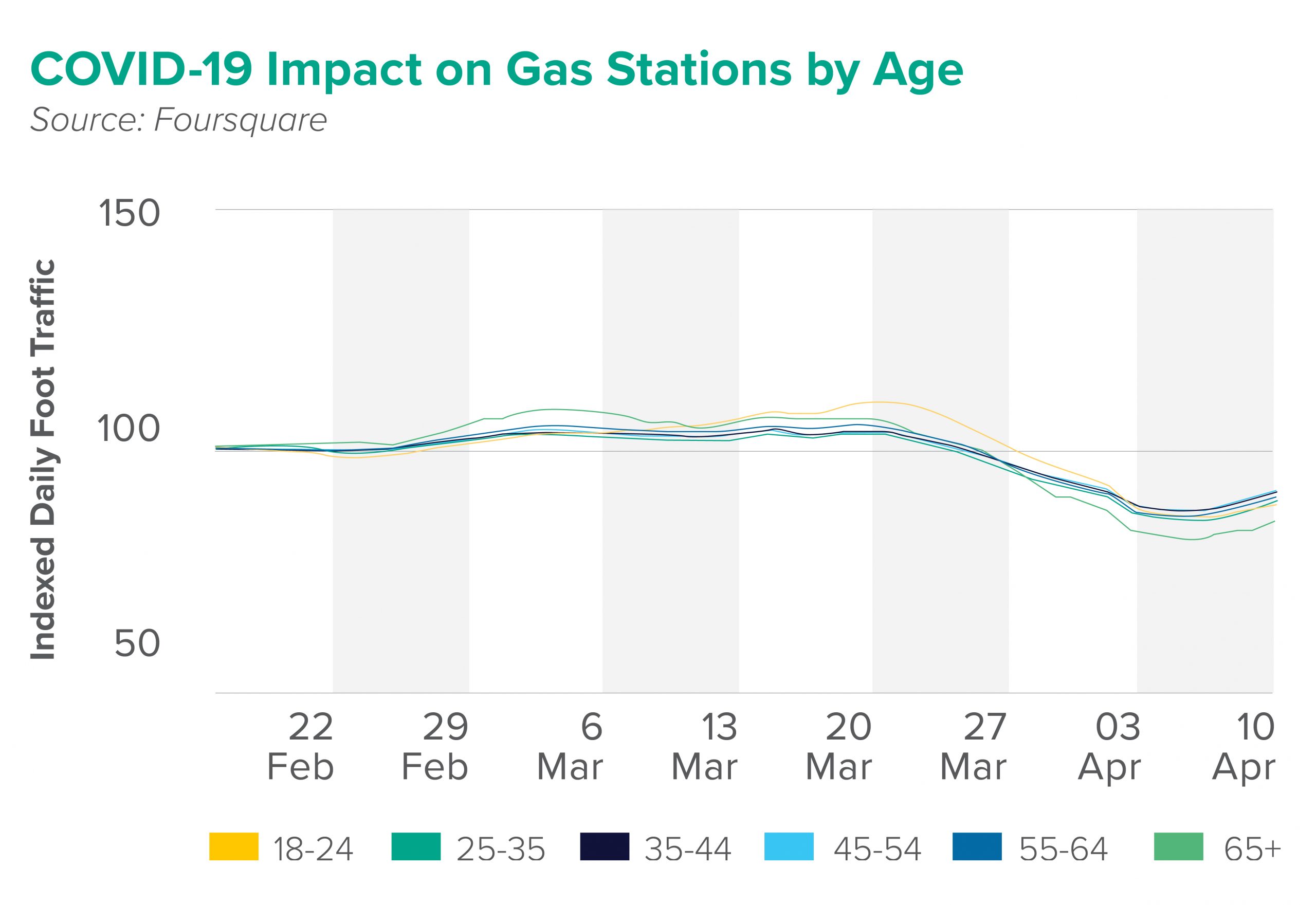

According to NACS, of the 152,720 convenience stores operating in the United States, 121,998 sell fuel. Even with lower fuel prices at the pump, by mid-March, fuel demand had collapsed as a result of social isolation practices curtailing fuel consummation, translating to fewer trips to convenience stores. Interestingly enough, the collapse in gasoline sales has not directly impacted c-stores with gas stations. Per gallon margins have skyrocketed since oil prices collapsed in early March. Although margins will eventually come down, the average U.S. c-store fuel earnings are currently higher than they were before the pandemic.

Guidance from our Agents

We urge investors to be proactive during this time and take the opportunity to understand your customers and reach out to tenants, corporate companies, or franchisees for their game plans. The recent outbreak has led convenience store retailers to implement new strategies in attempt to combat and control the changes in their business. Other efforts include enhanced cleaning protocols to make customers feel safe during this time and offer additional services.

C-stores are resilient to economic downturns and it’s likely we will see the strategies implemented today, such as curb-side pick-up and delivery, carry over into the stabilized market as concerned customers eventually return to their routines.

After the market settles, it’s likely we will see a new generation of c-stores. Customer’s heightened concerns about sanitation and food safety will influence the rebuild in operations and services. We could see staff execute self-service items and prove beneficial to have customer interaction. Operators should take this time to catch up with other retailers in terms of delivery. C-stores have the capability to provide groceries, household items, merchandise, and prepare food and beverages all in one delivery. Moreover, a loyalty program could measure the demand for this and help build customer relations.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.