Medical office sales topped $11 billion for five years straight, and retention rates trended between 75 and 83 percent for the last 11 years. With nearly 50 million Americans over the age of 65 as of 2016, healthcare services were already in great demand. Now, medical office buildings are faced with new challenges due to staffing outages, scarcity in personal protective equipment (PPE), and closures of specialty clinics, like dentists or specialized surgeons, as appointments are canceled or postponed. This report will cover the events occurring in healthcare commercial real estate and serve as guidance for healthcare investors.

Navigating COVID-19’s Impact on Healthcare

Fortunately, the Centers for Disease Control and Prevention (CDC) has a COVID-19 Preparedness Assessment Tool for healthcare providers and hospitals that facilities can refer to in a time of crisis. This tool provides guidance and training by outlining practices and steps to help prepare staff for an outbreak. The goal for every medical professional at this time is to reduce and control the rate of spread. However, the closure of medical offices results in impacts on owners’ bottom lines.

Non-Contact Methods Doctors are Practicing

- Drive-Through Service: Some clinics are offering curb-side appointments or testing for worrisome patients.

- Telehealth Visits: Either through phone calls or video chat, patients can have their check-up conducted virtually.

- Artificial Intelligence Technology: By sample scanning a patient’s face, AI technology can screen their temperature and identify who is likely to develop severe symptoms.

- Pandemic Drones: A tool that is being developed to scan crowds of people to monitor temperature, heart rates, coughing, and even blood pressure to help detect COVID-19 in a mass of people.

The inflating number of patients and hospital visits are drawing concern for space. The limited hospital capacity has medical professionals turning to other options. Some property owners, across all sectors, are offering their facilities to provide housing for healthcare workers or noncritical patients during the pandemic. Officials are also working with the Federal Emergency Management Agency to open temporary hospitals primarily in convention centers. For example, a 6,500-ton U.S. naval ship is docked at the Port of Los Angeles, serving as a makeshift hospital for the coming months.

Investor Response

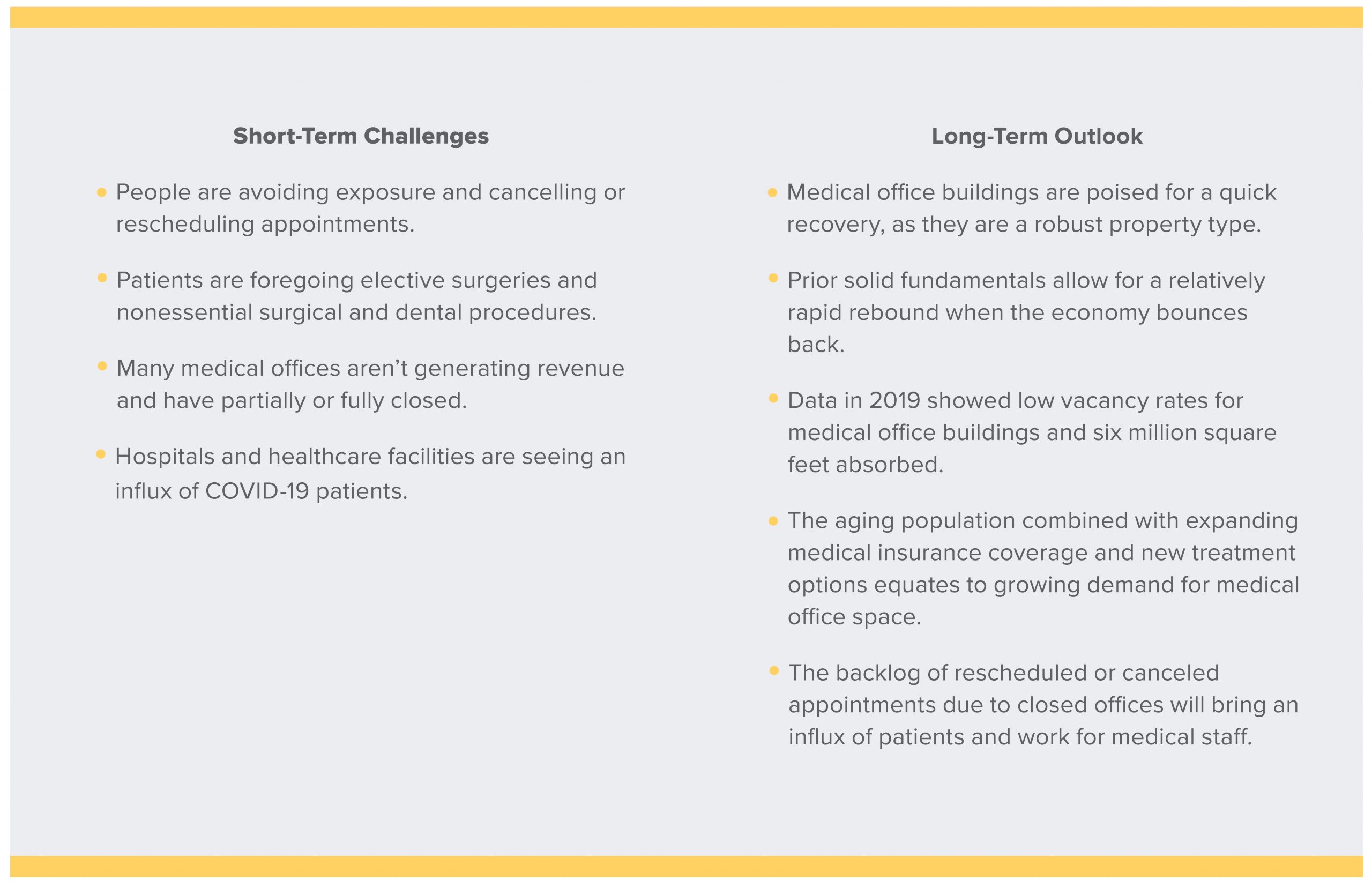

In the short-term, COVID-19 has resulted in many medical offices to full or partially close their practices, leaving many with no revenue stream. Once the pandemic subsides, this may translate to a wave of appointments at many practices, boosting long-term financial stability. Additionally, the nation’s sizable baby boomer population will provide for investor confidence, particularly for well-located assets. Some investors are still going ahead with medical office building acquisitions, viewed as a defensive play and considered a safe bet in an uncertain environment. Most of the one-off buyers, who are not in an exchange and have no immediate need to buy, are staying precautious. Investors, who are under contract and need to complete their inspections are having trouble getting appraisers to visit their property. Some appraisers are only doing appraisals on the outside of the buildings, and not going inside the building. The financial impact on the healthcare sector will be determined by reimbursement or special funding related to coronavirus. Commercial insurers have claimed they will cover for COVID-19 testing and waive copayments. The future of access to healthcare and the design of future facilities will likely be influenced by the actions taken today.

Advice from our Agents

Despite the unprecedented pandemic event, the medical office market is recession-resilient. Though some medical offices many face short-term turmoil due to closures or inability to pay rent, demand for medical office space remains. It is a niche market with limited supply and significant demand from investors. The ongoing trend of performing medical procedures at outpatient facilities rather than hospitals and overall growth in healthcare spending contributes to this demand. And, given the current market, investors are looking to invest more in defensive industries.

Key Indicators

- Buyers undergoing a 1031 Exchange are actively looking for medical properties before their exchange deadline is met

- Sale leasebacks are still getting completed

- Private institutional capital continues to chase medical buildings

Seeking Relief

To expedite economic relief, tenants and owners can obtain support through the $2 trillion stimulus package, the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The CARES Act includes a $350 billion small business loan program, the Paycheck Protection Program (PPP), designed for businesses having fewer than 500 employees to be administered through the Small Business Administration (SBA). Many healthcare providers can utilize the PPP to maintain their employees and complete payment of the mortgage, rent, and utilities. As for owners looking to cash out, now is the prime time to do so as interest rates are low, and private institutions continue to look and buy deals, whereas if they wait three to six months, there is a risk of losing an opportunity because it can be a different market at that point.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized agent for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.