Amidst the COVID-19 outbreak, local and state governments are enforcing restaurants and bars to close dine-in services temporarily. As a result, quick-service restaurants (QSR), including Starbucks, Taco Bell, and Chick-fil-A, are encouraging customers to grab their food to-go. After visits to QSRs increased by 11 percent from February 17 to March 13, according to Foursquare, foot traffic remained relatively stable, down only 16 percent from February 17 to April 10. In this report, we will take a look at how quick service restaurants and quick service restaurants with drive-thrus are performing, given the current COVID-19 pandemic.

Navigating the QSR Drive-Thru Market

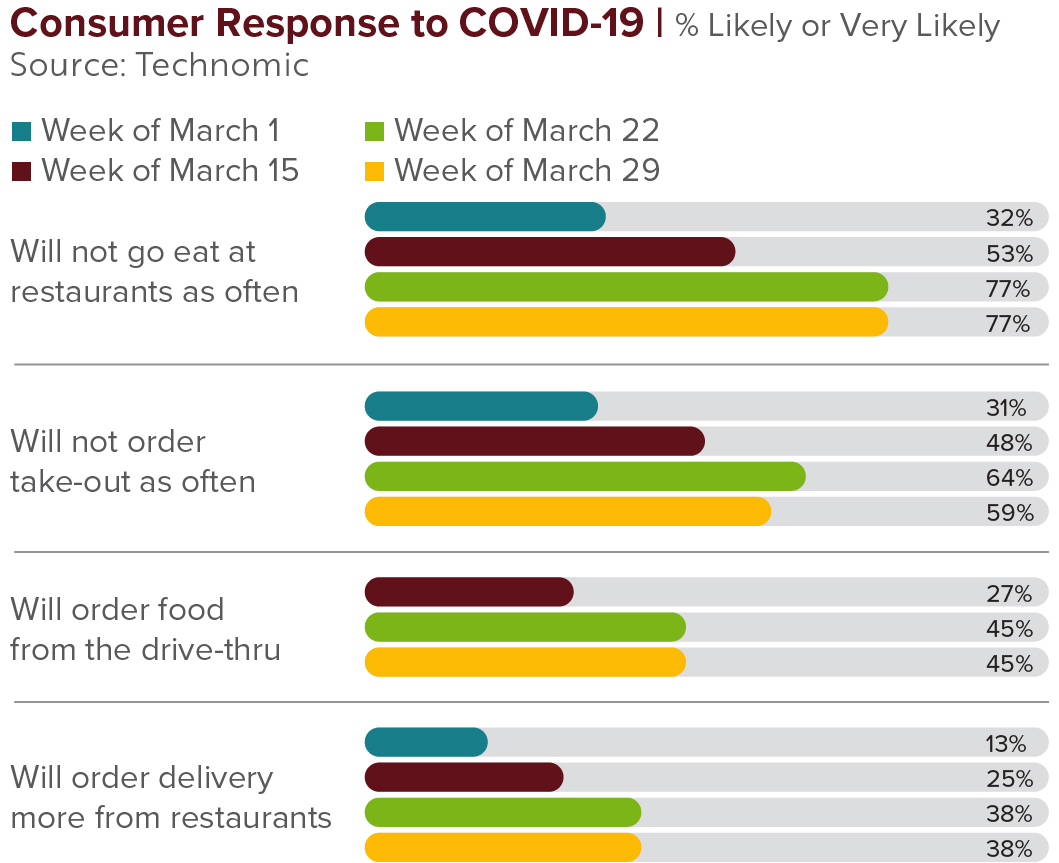

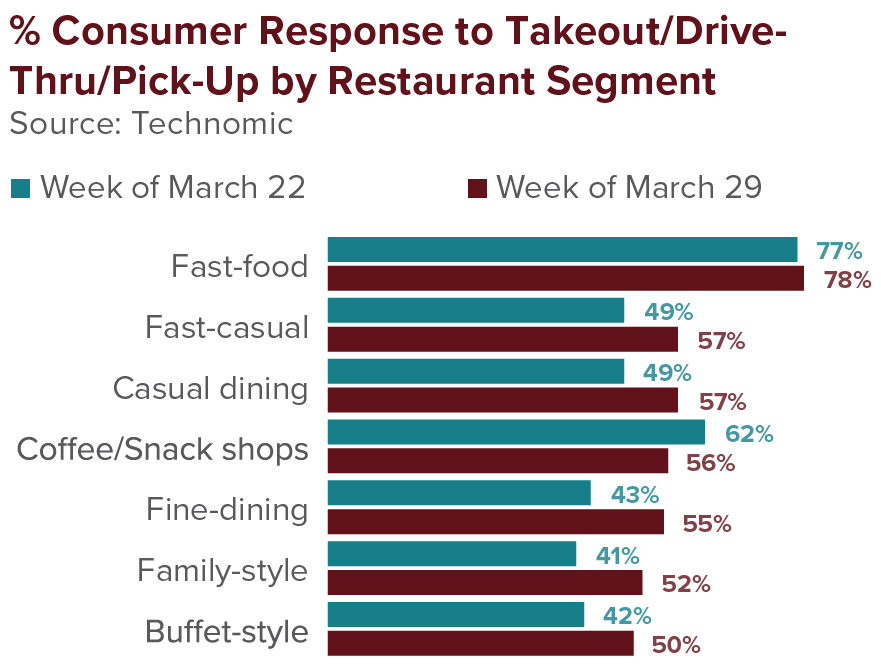

Already serving as a form of contact-less delivery, drive-thrus are becoming a primary source of revenue for QSRs during COVID-19. Datassential, a software and insights company, found that the coronavirus has impacted 60 percent of consumers by causing concern for eating out. In their findings, consumers are anticipated to use the drive-thrus more frequently by 11 percent. For the restaurants that remain open, they are offering pick-up or delivery services and are seeing a 20 percent increase in to-go sales.

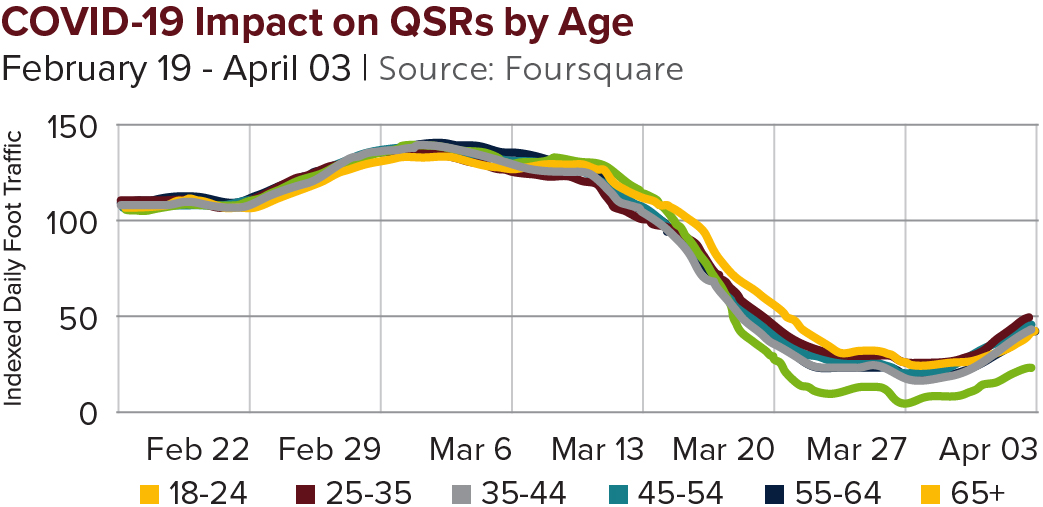

Once the COVID-19 outbreak began, younger people aged 18 to 24 were slower than other age groups to visit fast food and casual dining restaurants, according to Foursquare data. While visits to casual dining chains remain low, visits to fast food chains have seen slight upticks in traffic from the week ending March 27 to the week ending April 3. Further, 23.5 percent of consumers surveyed March 25 to March 31 planned to visit a fast food restaurant within the next week.

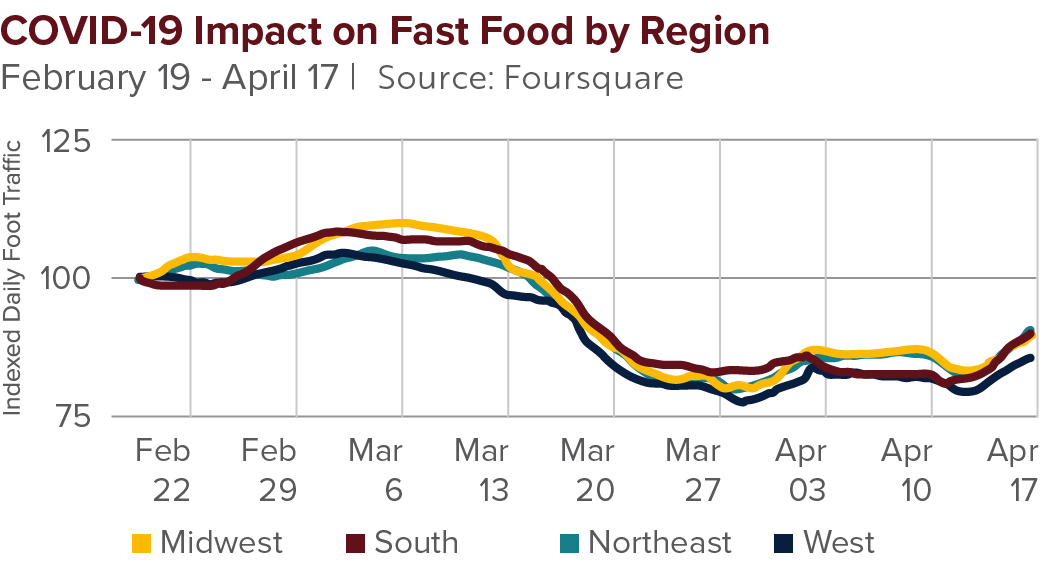

QSR visits declined the most in urban areas, down 21 percent, compared to rural areas, down only 11 percent. Moreover, QSRs have experienced the greatest decline in the West, down 18 percent, with smaller drops in the Midwest and Northeast, decreasing 13 percent and 14 percent, respectively. 98 percent of customers visiting QSRs are opting for drive-thrus or take out, according to Foursquare survey responders April 8 to April 14.

Fortunately, prior to the outbreak, leading restaurant brands were already focusing efforts towards drive-thru improvements. So long as other QSRs follow their lead, brands can develop a strategy that will aid in current events, which will benefit long-term. Considering the actions and behaviors taken today will help shape the future of customer habits and expectations.

Drive-thru performance

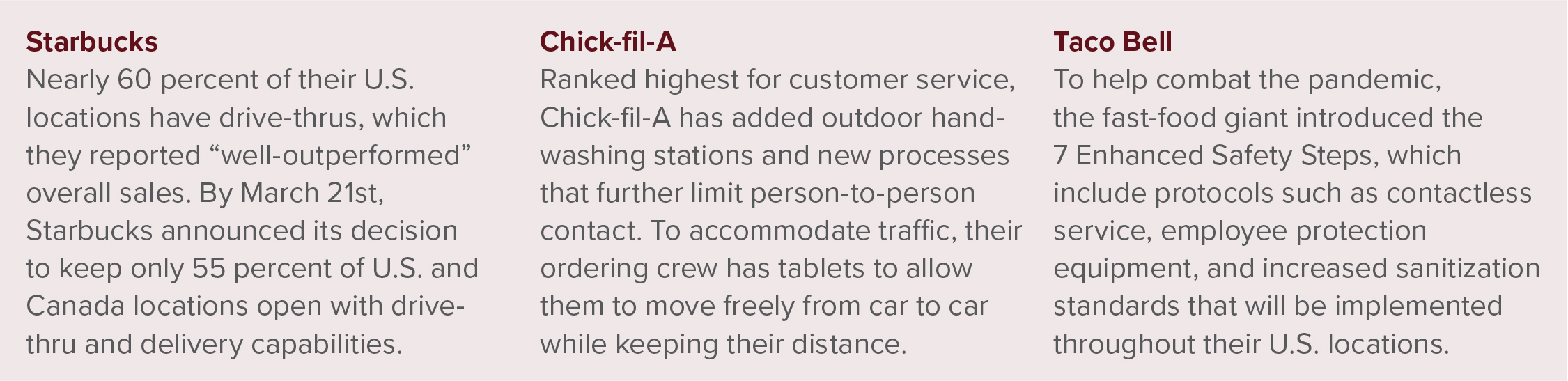

According to Zion Market Research released in 2019, drive-thru restaurants are to push market growth, stating, “Rising hectic lifestyles with dual-income is anticipated to elicit the demand for fast food in the forecast period.” Moreover, given the current market conditions due to COVID-19, there is a growing fondness towards inexpensive food with no wait time, which may further prompt fast-food industry growth over the coming years. As of today, only 20 percent of restaurants in operation currently have drive-thrus. Among the restaurants encouraging customers to get their food to-go during the outbreak are Starbucks, Chick-fil-A, and Taco Bell. All of which are utilizing their drive-thru lanes more than ever to limit large gatherings while still distributing food. Further, each of these restaurants has announced additional measures and precautions to their locations, including adjusting store hours, limiting operations through only the drive-thru, and implementing more sanitary procedures. Before the outbreak, these are the actions each brand took to improve its drive-thru performance.

QSRs offer valuable yet affordable meals, which grow increasingly important during an economic downturn. For top brands with existing drive-thru systems, the travel limitations may serve beneficial, especially in areas with less COVID-19 concern and experiencing smaller foot traffic decline. Drive-thrus allow restaurants to push through and mitigate loss in in-store sales. So long as customers continue to crave and desire convenient fast food, drive-thru properties should have limited impact, allowing the sector to rebound quickly once the market normalizes.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized agent for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.